Market size and dynamics

Pay TV

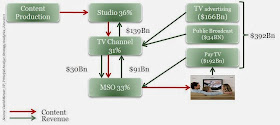

TV content is created by studios and content creators and sold to channels and content aggregators.

In 2010, according to Strategy Analytics, it is a market that generated nearly 400 billion dollars globally, about half from advertising and half from subscription and services in 2010. These $400B were split approximately 1/3 to service providers, 1/3 to content aggregators and 1/3 to content owners.

Over -The-Top

These content owners distribute their content on the web, directly to the consumer. Netflix, Hulu, Youtube, HBO, BBC, NFL, etc... are the better known brands but there are new global and local players diving in every day.

The fundamental difference in this model, is that the content owner just needs the consumer to have a screen (TV, mobile or PC), a connection (mobile or fixed broadband) and if the screen is not connected, an access gateway (set top box, router, net box, game console) to sell its content and services.

While this market is much smaller (only about $8 billion in 2010), it is growing fast and threatens the revenue model of Pay TV in the sense that in this model, revenues are split approximately 60/40 respectively between content owners and aggregators. Nothing for service providers!

As you can imagine, the fear from service providers is that OTT starts cannibalizing their legacy revenue, as their current suppliers turn into fierce competition. In the next posts, I will look at the dynamics and competitive field in the ecosystem (devices, operating systems, app stores), as well as new trends in standards and consumer behaviors together with a few vendors and service provider strategies to take advantage of or mitigate these new threats and opportunities.

No comments:

Post a Comment

Hello, thanks for your comment. Comments are moderated please allow a few days for them to appear.