Service orchestrators have not really been able to be successfully deployed at scale for a variety a reasons, but primarily due to the fact that this control point was identified early on as a strategic effort for network operators and traditional network vendors. A few network operators attempted to create an open source orchestration model (Open Source MANO), while traditional telco equipment vendors developed their own versions and refused to integrate their network functions with the competition. In the end, most of the actual implementation focused on Virtual Infrastructure Management (VIM) and vertical VNF management, while orchestration remained fairly proprietary per vendor. Ultimately, Cloud Native Network Functions appeared and were deployed in Kubernetes inheriting its native resource management and orchestration capabilities.

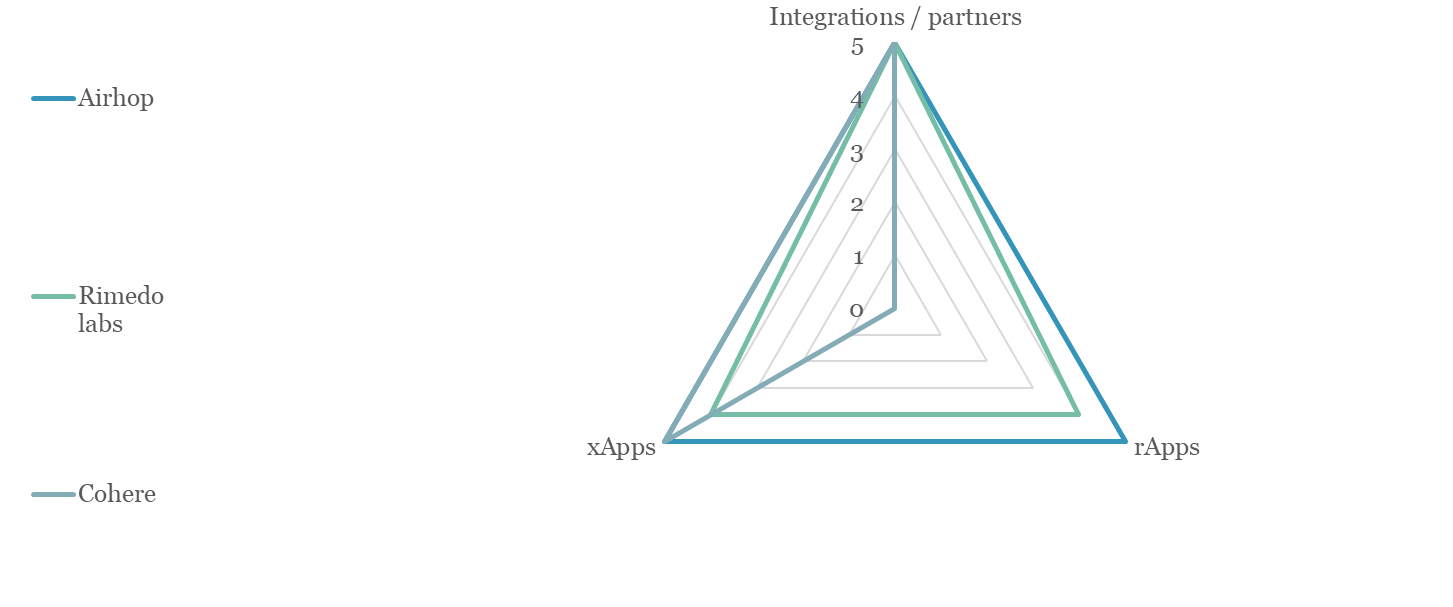

In the last couple of years, Open RAN has attempted to collapse RAN Element Management Systems (EMS), Self Organizing Networks (SON) and Operation Support Systems (OSS) with the concept of Service Management and Orchestration (SMO). Its aim is to ostensibly provide a control platform for RAN infrastructure and services in a multivendor environment. The non real time RAN Intelligent Controller (RIC) is one of its main artefacts, allowing the deployment of rApps designed to visualize, troubleshoot, provision, manage, optimize and predict RAN resources, capacity and capabilities.

This time around, the concept of SMO has gained substantial ground, mainly due to the fact that the leading traditional telco equipment manufacturers were not OSS / SON leaders and that Orchestration was an easy target for non RAN vendors wanting to find a greenfield opportunity.

As we have seen, whether for MANO or SMO, the barriers to adoption weren't really technical but rather economic-commercial as leading vendors were trying to protect their business while growing into adjacent areas.

Recently, AI-RAN as emerged as an interesting initiative, positing that RAN compute would evolve from specialized, proprietary and closed to generic, open and disaggregated. Specifically, RAN compute could see an evolution, from specialized silicon to GPU. GPUs are able to handle the complex calculations necessary to manage a RAN workload, with spare capacity. Their cost, however, greatly outweighs their utility if used exclusively for RAN. Since GPUs are used in all sorts of high compute environments to facilitate Machine Learning, Artificial Intelligence, Large and Small Language Models, Models Training and inference, the idea emerged that if RAN deploys open generic compute, it could be used both for RAN workloads (AI for RAN), as well as workloads to optimize the RAN (AI on RAN and ultimately AI/ML workloads completely unrelated to RAN (AI and RAN).

While this could theoretically solve the business case of deploying costly GPUs in hundreds of thousands of cell site, provided that the compute idle capacity could be resold as GPUaaS or AIaaS, this poses new challenges from a service / infrastructure orchestration standpoint. AI RAN alliance is faced with understanding orchestration challenges between resources and AI workloads

In an open RAN environment. Near real time and non real time RICs deploy x and r Apps. The orchestration of the apps, services and resources is managed by the SMO. While not all App could be categorized as "AI", it is likely that SMO will take responsibility for AI for and on RAN orchestration. If AI and RAN requires its own orchestration beyond K8, it is unlikely that it will be in isolation from the SMO.

From my perspective, I believe that the multiple orchestration, policy management and enforcement points will not allow a multi vendor environment for the control plane. Architecture and interfaces are still in flux, specialty vendors will have trouble imposing their perspective without control of the end to end architecture. As a result, it is likely that the same vendor will provide SMO, non real time RIC and AI RAN orchestration functions (you know my feelings about near real time RIC).

If you make the Venn diagram of vendors providing / investing in all three, you will have a good idea of the direction the implementation will take.